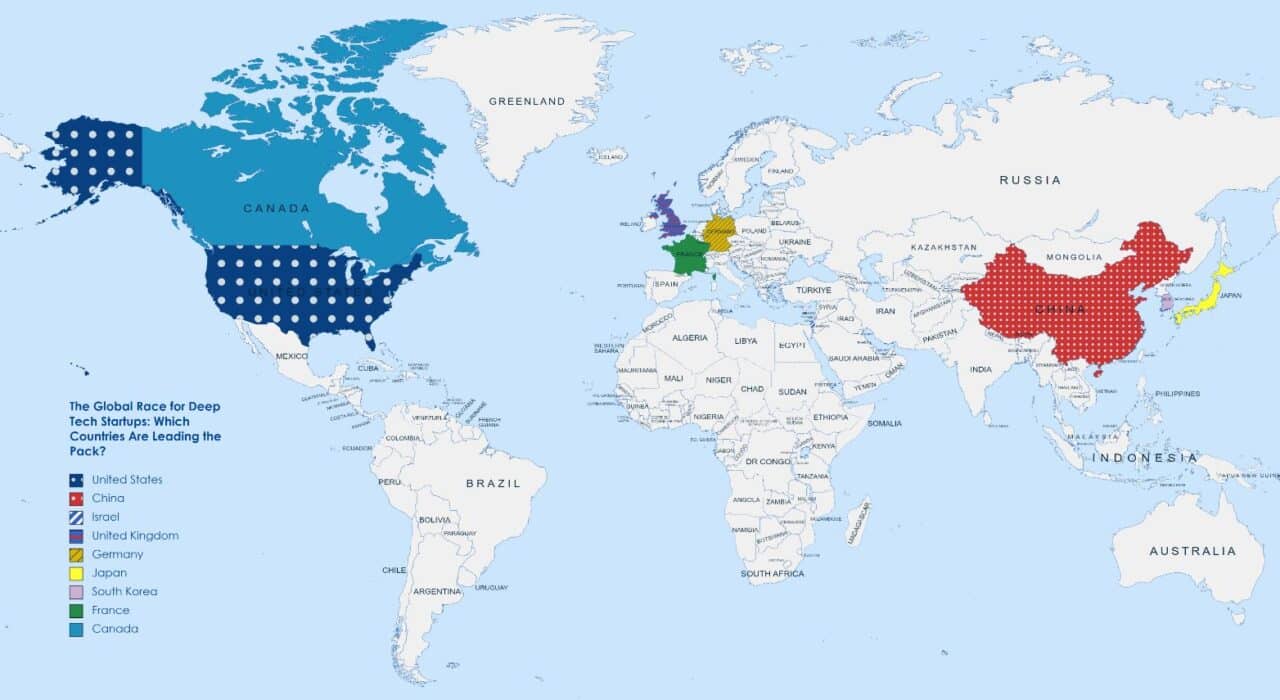

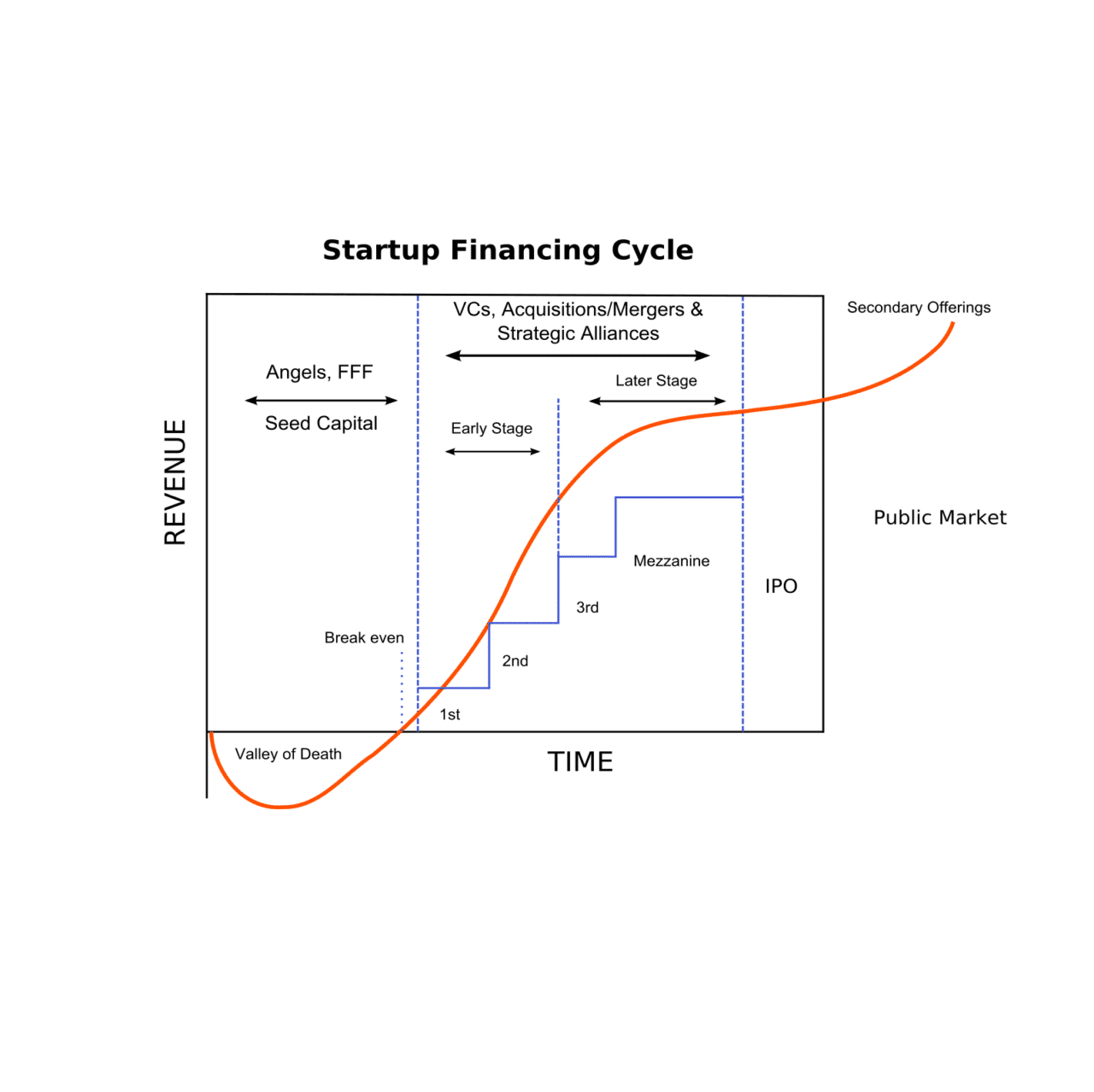

A Roadmap to Funding for Deep Tech: Grants

What types of grants are available to fund your deep tech startup’s journey? Launching a deep tech startup can be an exciting journey. At the same time securing funding and support is a crucial step in turning your innovative ideas into reality.