TD Shepherd is thrilled to congratulate the exceptional team at Innatera Nanosystems on the successful closing of their recent investment round, raising an impressive 15 million euros! This milestone achievement marks a significant step forward in advancing the innovative landscape of ultra-low-power neuromorphic processors.

With support from Invest-NL’s Deep Tech Fund, the EIC Fund, and existing backers MIG Capital, Matterwave Ventures, and Delft Enterprises B.V., Innatera is geared-up to accelerate its mission of revolutionizing the integration of intelligence into sensors and sensor-based devices.

Well done, Innatera!

To find out more, please visit: https://bits-chips.nl/artikel/delfts-innatera-bags-e15m-for-mass-production-of-brain-inspired-processor/

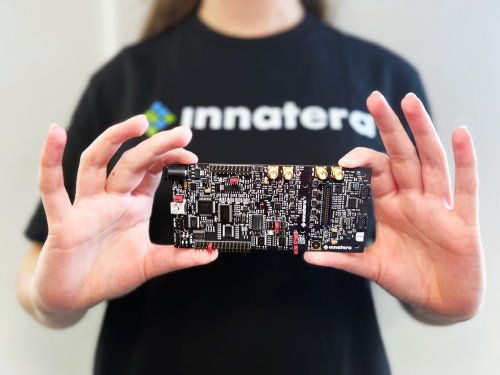

Image Credit: Innatera