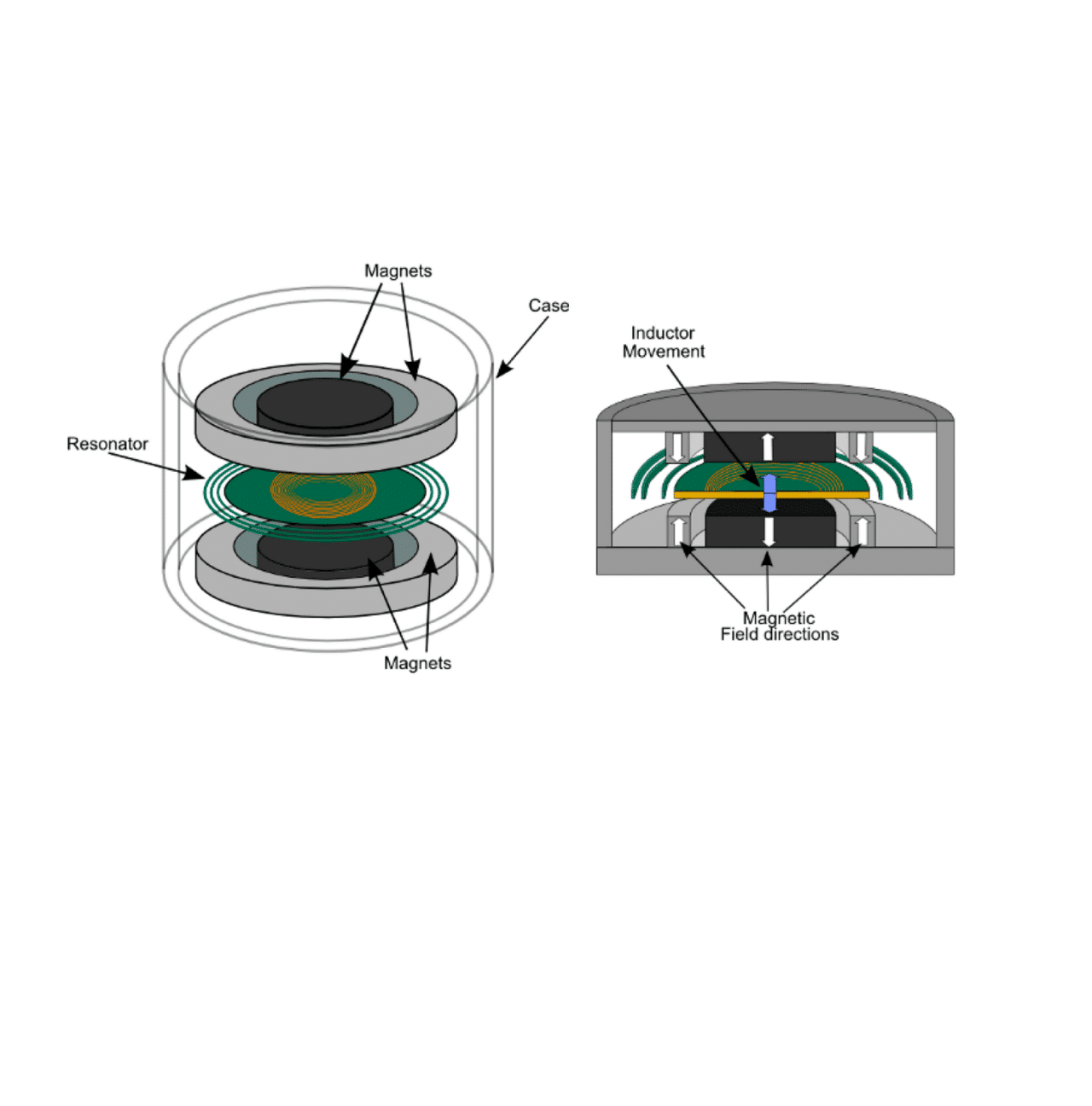

Kinetic or electrodynamic harvesters convert movement or vibration energy into electrical energy based on Faraday’s law of induction by moving a coil through a permanent magnetic field. A very well-known application making use of this principle is the pickup element of a record player.

More and more companies offer IoT devices based on this energy harvester principle, e.g.,

Revibe which offers IoT sensors for railway and mining which are self-powered over its entire operational lifetime, so no batteries have to be replaced. (https://revibeenergy.com)

Enocean which offers a switch to control, e.g., your indoor light. Just pressing the switch gives enough energy to send a couple of bytes to a receiver to switch a device on or off. (https://www.enocean.com/en/)

Enervibe which offers energy harvesters for smart tyres scavenging up to 30mW depending on the vehicle speed. Based on this energy harvester they offer a self-powered tyre monitoring system measuring, tyre load, tyre air temp, road condition, tyre pressure, rubber wear, and speed. Enervibe also offers a KEH-based sensor for smart shoes, eliminating the need for battery replacement. (https://enervibe.co)

Above are just a couple of examples showing the diversity of the different types of Kinetic Energy harvesters existing already today. When compared to photovoltaic, electrodynamic harvesters do not have the highest power density (the power density of machine vibration is around 800 microwatt/m3). However, it is still a very useful source of energy for powering IoT devices.

Image credit: mdpi.com